Check out the pictures of the amazing renovation our team completed recently for one of our managed properties, increasing its’ rent by £250 a month!

Inflation UK 2023

Curious about inflation in 2023? Check this out from The Bank of England:

Full article: https://www.bankofengland.co.uk/explainers/will-inflation-in-the-uk-keep-rising

Why is inflation expected to fall quickly during 2023?

There are few reasons why we expect inflation to fall quickly this year.

First, wholesale energy prices have fallen a lot. In Europe, they have halved over the past three months. You may not have felt the impact of this on your bills yet. But this change will help to bring inflation down.

Second, we expect a sharp fall in the price of imported goods. That’s because some of the production difficulties businesses have faced are starting to ease.

Third, as people have less money to spend, we expect there to be less demand for goods and services in the UK.

All this should mean that the prices of many things will not rise as quickly as they have done.

There are signs that inflation might now have turned a corner and begun to fall a little. We need to make sure it continues to fall and stay low.

We expect inflation to begin to fall from the middle of this year and be around 4% by the end of the year. We expect it to continue falling towards our 2% target after that.

Current inflation rate10.1%

Target 2%

It’s our job to make sure inflation comes down to our 2% target. Raising interest rates is the tool we use to bring inflation down.

We can’t always stop inflation from going higher or lower than that. But we can make sure it comes back to that target.

The way we can do that is by changing interest rates. We’ve been raising interest rates for over a year now. It take time for the full impact of these rises to work (about 18 months to two years).

We raise interest rates in the UK by raising our interest rate, Bank Rate. It is also widely known as ‘the base rate’ or just ‘the interest rate’.

Bank Rate influences many other rates in the UK, including those you might have for a loan, mortgage or savings account.

On Thursday 2 February 2023, we raised our interest rate (Bank Rate) by 0.5 percentage points to 4%.

Raising interest rates means that many people will face higher borrowing costs. And some businesses will face higher loan rates. We know that this will make things hard for many people.

But we must act to lower inflation because low and stable inflation is vital so that money keeps its value and people can plan for the future with confidence. It’s fundamental for a healthy economy.

What we are doing about the rising cost of living

How does raising interest rates lower inflation?

People have asked us why putting up UK interest rates will help. Some say it won’t tackle the causes of the inflation and it will only make the squeeze on household finances even worse.

Higher interest rates work by making it more expensive for people to borrow money to buy things. Higher interest rates also encourage people who can save to save rather than spend. Together, these things mean there will be less spending in the economy overall.

When people spend less on goods and services overall, the prices of those things tend to rise more slowly. Slower price rises mean a lower rate of inflation.

We know higher rates are hard for many people. But we must take this action to make sure inflation comes down and stays down.

Having high inflation for a long time would cause even greater hardship, especially for the least well-off and those in unsecure employment.

The action we take to keep inflation low and stable is called monetary policy.

Our latest property renovation!

EPC – What it is and how it could help to save you money this winter

With the cost of bills on the rise in the lead-up to winter, we are all trying to save money where we can. An EPC can help to identify areas in your home that could be improved to decrease the energy consumption. Have a look at the below to become better acquainted with your property’s EPC and discover how it could save YOU money!

What is an EPC?

An EPC or ‘Energy Performance Certificate’ is a legal document comprising of 5-7 pages that measures the energy efficiency of your property from A (highest) to G (lowest).

When do you need an EPC?

You need an EPC when doing the following:

- Selling a property

- Letting a property

- Re-mortgaging a property

- Making a financial claim on a government grant scheme (e.g. Renewable Heat Incentive Scheme or the Energy Company Obligation)

Who can carry out an EPC?

An accredited EPC assessor – you can find one in your area by searching online.

How much will an EPC cost?

There is no set price for an EPC, however you can expect to pay between £40-£100. *if you market your property under Sole Agency with Hausman & Holmes and do not currently have an EPC, we will arrange this for you and cover the cost.

What will be shown on the EPC?

The EPC will give you a summary of the types of heating, insulation and lighting currently in your property and will give each a rating from 1 star (least efficient) to 5 stars (most efficient).

It will also provide recommendations on how you can improve the energy efficiency of your home and give estimated costs of each improvement and an approximation of how much money you could save each year once the alterations are made.

Examples of changes you can make to improve your property’s EPC rating:

- Switching your lightbulbs to energy efficient alternatives

- Insulating your roof, walls & floors to minimize heat loss

- Having double or triple glazing installed to your windows

- Installing a smart meter so you can better understand how much energy your property is using

- Replacing old boilers with newer, more energy efficient ones

Here at Hausman and Holmes, we have a dedicated, professional and friendly team who are happy to answer any questions you may have, so please feel free to contact us on 020 8458 8555

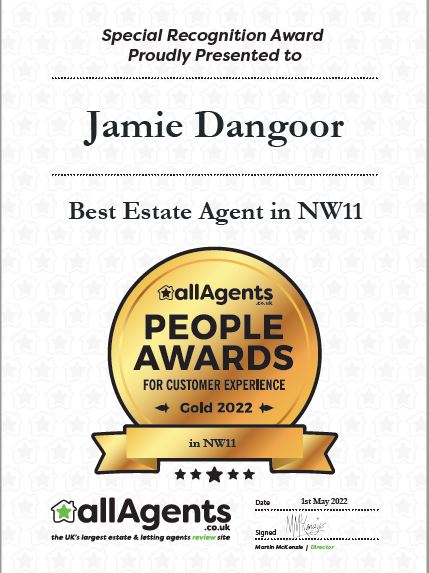

Congratulations Jamie Dangoor!

We would like to say a big CONGRATULATIONS to our very own Jamie Dangoor for winning the AllAgents People Awards for Estate Agent of The Year in NW11. It is so well deserved and the team are very proud!

A big thank you as well to everyone who left reviews and ratings; your feedback is of the utmost importance to us. We always strive to be the best company we can be and without your reviews we would not be able to keep the high standards we have set for ourselves. Our clients are, first and foremost, at the heart of everything we do and every decision we make.

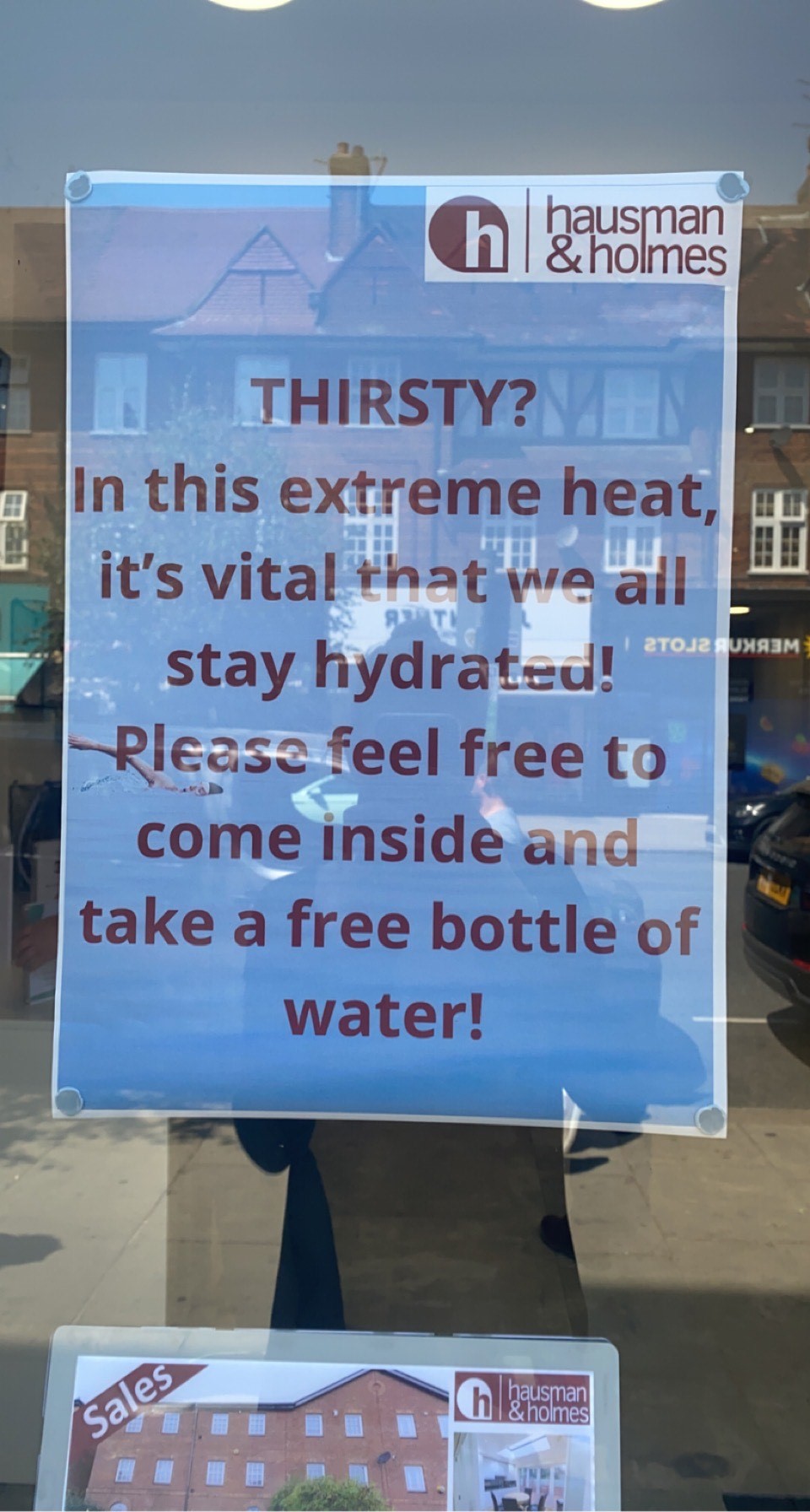

Summer Heat

We’re not like the others…

A Spring survey completed by Rightmove.com found the following factors were most important when sellers decided to switch their estate agent. Here at Hausman and Holmes, we are confident that you will not experience any of these problems whilst using our company to sell your property and here’s why:

1) “My agent wasn’t doing enough to promote the property”

Hausman and Holmes promise: We promote your property on ALL of the major property sales websites, but that’s not all; your property will be featured on our website as a ‘property of the week’, alongside our window displays, our big screen AND all of our social medias. We match prospective buyers for your property as soon as it goes live so we can make sure everyone whose search criteria matches your property will receive a brochure, and we don’t stop marketing until we have secured a sale.

2) “The agent wasn’t responsive enough”

Hausman and Holmes promise: Here at Hausman and Holmes, communication is KEY, and your sales negotiator is there to make your life easier, NOT harder. You will be given viewing feedback within 24 hours of any and all viewings of your property. You are encouraged to reach out to us as often as you’d like to ask us any questions about the progress of your property from initial valuation right through to completion. We will also call you WEEKLY to update you about any progressions and to answer ANY of your questions so that you are confident we are doing all we can to sell your property.

3) “They were not arranging enough viewings”

Hausman and Holmes promise: We have a database of over 2,500+ registered prospective buyers who are keen to view the properties we list and we make sure they know about your property as soon as it is live! We arrange viewings 7 days a week and always try our best to accommodate, even on short notice. We are confident that a lack of viewings will not be a concern for you.

4) “The agent wanted to reduce the asking price”

Hausman and Holmes promise: We aim to give you the most accurate valuation of your property from the get-go so that you can achieve the sale price that is not only realistic, but is right for YOU.

5) “The types of buyers attending the viewings were not suitable”

Hausman and Holmes promise: Here at Hausman and Holmes, we carefully screen each registered purchaser to ensure that we understand their needs and present them with only the properties that match their criteria. Our buyers are serious – we do not want to waste your time or theirs, so we have implemented a system that ensures only those ready to buy are matched to your property. With a database of over 2,500+ vetted registered customers, we never have a problem filling the diary with viewings.

6) “The quality of the listing was poor i.e. photos, property description etc”

Hausman and Holmes promise: Hausman and Holmes ensure all of our media is second-to-none. We work with a fantastic, professional company to take photographs of your property and produce your floorplan, as well as create a full 360 degree VR tour of your property so that prospective buyers can really get a feel for it before they view. We will always make sure your property is represented the way it DESERVES - with high quality videos, photographs and wording.

7) “They were not doing a good job of selling the property during viewings”

Hausman and Holmes promise: We are eager to learn all about the perks and charms of your property and will make sure everyone who views it is aware of them too. Every single property is a gem to us and won’t be treated as anything less. We are also knowledgeable and passionate about the North London area, having been a part of this community ourselves for decades. We will go out of our way to highlight local areas of interest, schools, parks, places of worship and nearby entertainment so that prospective buyers can easily see themselves as a part of it, with your property at the heart.

Ask me (almost) anything!

Do you want to know more about the current property climate? Are you a first time buyer looking to get on the property ladder and need some tailored advice? Are you looking into property investment? Do you want to know what colour socks I’m wearing today? Here’s your opportunity to ask me anything! (well…maybe not the last thing…) Here at Hausman and Holmes, we are more than happy to give you free advice with no obligation, so why don’t you give us a call or email us and we’d be thrilled to answer any questions you have about the property market.

Stunning Bathroom Renovation!

How an interest rate rise in the coming months could impact your mortgage

Check out this article from Rightmove – How an interest rate rise in the coming months could impact your mortgage

After weeks of speculation, the Bank of England has announced it is keeping interest rates at 0.1% this month, although a rise could still happen before Christmas.

Interest rates have remained at the historic low of 0.1% since the start of the pandemic, however the Bank has indicated that modest rises are expected in the coming months. The next decision takes place on 16th December.

What is the Bank of England base rate?

Set by the Bank of England (BoE), the base rate is a benchmark for the cost of borrowing money. It is important to homeowners because mortgage lenders (and credit card companies and loan providers) base the rates they charge on it. If the base rate rises, so will the cost of borrowing.

Why is rising inflation an issue?

From rising energy bills, to an increasingly expensive weekly shop, the rate of inflation affects everything we need to pay for. Grocery prices are estimated to have already increased over the past month or so, as manufacturers pass on the rising costs of labour, materials, energy and transport.

“Higher inflation will clearly exert a squeeze on household budgets,” explains Paul Archer, Nationwide’s Senior Manager – Mortgages.

To relieve the squeeze, the BoE has a target of halving inflation to 2%, and one of the key ways to achieve this is by increasing interest rates.

How will increasing interest rates affect my mortgage?

Any increase in rates could have an impact on your monthly mortgage payments, although it depends on what sort of mortgage you have. If you have a fixed-rate deal – and Paul Archer says around 80% of homeowners opt to tie themselves in to a set rate for two or more years – the good news is that it will be business as usual, and your monthly repayments won’t change, at least until you need to remortgage.

But, if you are among the 20% of borrowers with a variable or tracker mortgage, or your fixed deal is coming to an end, your monthly outgoings will almost certainly go up.

The interest rate paid on tracker mortgages is usually the BoE base rate plus a set percentage. For example, the current base rate of 0.1%, plus 1%, would mean you would be paying 1.1% interest right now.

A standard variable rate is what you’ll be transferred onto if the term of your fixed rate deal, or discount deal, ends before you remortgage. These rates tend to be higher than other mortgage rates.

Rate increases are likely to be implemented slowly. Historically banks have gone for 0.25% at a time to soften the blow a little.

To put this into perspective, if you had a 25 year, £250,000 mortgage, and were paying 2% interest, your monthly bill would be £1,060. If your rate was increased to 2.25 per cent, that payment would increase to £1,090 per calendar month. If it rose again to 2.5 per cent, your mortgage would cost you £1,122 a month.

Has all the speculation about interest rate increases started to have an impact on mortgages already?

Yes. Most high street lenders have already begun increasing their interest rates in anticipation of a rate rise before or after Christmas. Last month, Barclays, HSBC, NatWest, Santander, and TSB all raised prices on some products.

“Fixed-rate mortgages are based on swap rates,” explains Paul Archer of Nationwide. “In recent weeks, swap rates have increased as the financial markets factor in a rate rise, and as such the cost of funding for banks and building societies has increased.

“This in turn is factored into the mortgage rates offered by lenders.”

This might sound like terrible news, but it’s important to keep things in perspective. There are still two- and five-year deals out there at around the 1% mark, which is very cheap lending compared to what homeowners were paying a decade or two ago.

What can I do about it?

If you’re on a tracker or variable mortgage, you could shop around to see if you can find a cheaper option with a fixed mortgage, although you might have to pay an early redemption fee first, and that might wipe out the benefits of swapping immediately. You should speak to a qualified mortgage advisor if you are unsure which options would be best for your individual circumstances.

If your fixed rate deal is due to end within the next few months, you could see what your options are for locking into a good deal now, while you can. Many banks will allow you to apply for current deals several months before your mortgage expires. Because this can be a lengthy process, it’s a good idea to start this process within six months of your current deal ending.

Another piece of good news is that the more you have paid off, the better mortgage deal you’ll be able to find. “The more equity you have in your home, the lower rate a lender is likely to offer,” says Paul Archer. “Rates at 95% loan to value (LTV) are higher for those at 60% LTV.

“If, during the term of the deal, you manage to move into a lower LTV band, you could find you are offered a lower rate than you were on before,” he says.